SCA profits dive in ‘challenging advertising market conditions’

Southern Cross Austereo (SCA) enjoyed a sustainable increase in digital revenue for FY24, however group net profits were halved “amid an industry-wide downturn”.

Digital has proven the saviour to SCA’s overall revenues, which dipped 1% from FY23. Digital’s 43% growth helped to offset the 1.7% fall in broadcast radio revenues, and a 8.6% drop in TV.

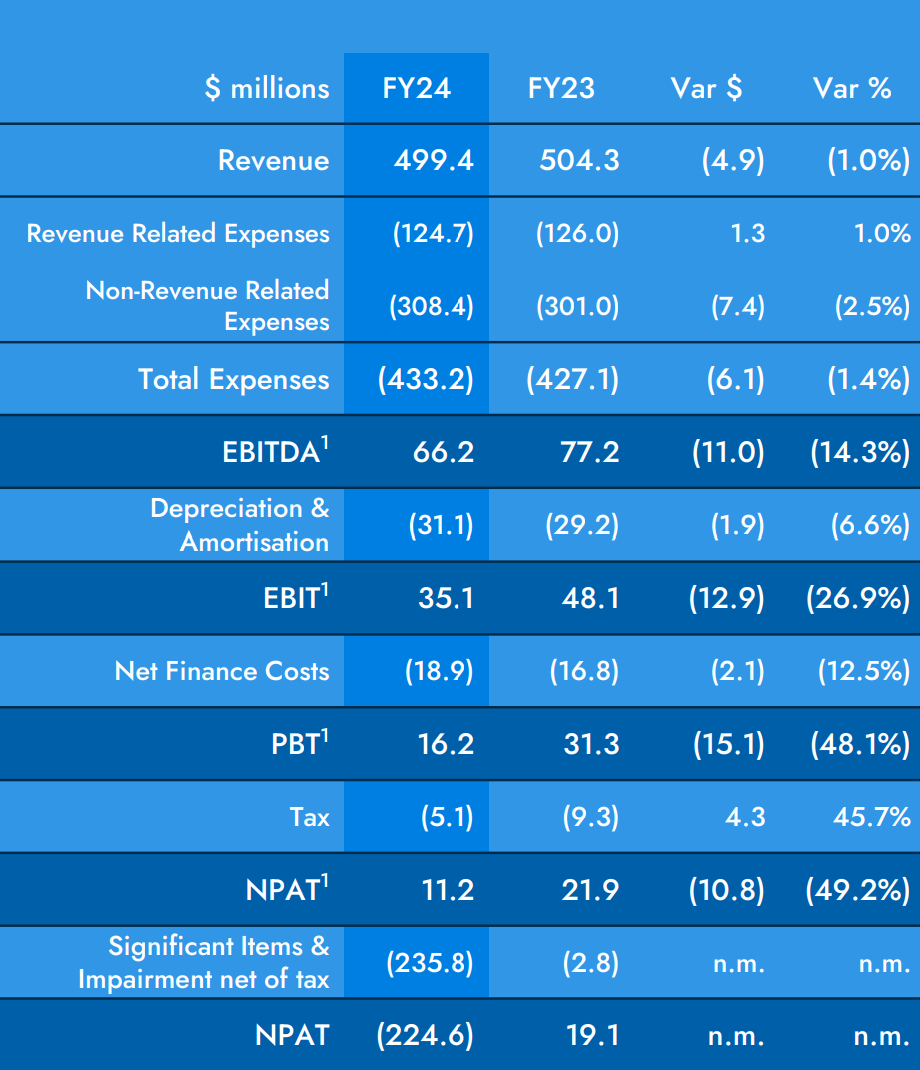

Expenses rose 1.4%, while depreciation and amortisation increased 6.6% due to “accelerated LiSTNR depreciation”.

Earnings before tax fell by 26.9%, while net profits after tax were slashed, down 10.8 million to sit at just $11.2 million – compared to $21.9 million in FY23.

Broadcast radio revenue decreased by $6.0 million, a 1.6% decline: Metro Radio revenue dropped by 2.7%, down $5 million “amid an industry-wide downturn”, which regional radio grew by 0.8%, up 1.3 million. Broadcast radio EBITDA was $87.2m, a decrease of 10.9%.

Digital revenue grew 42.2%, up 10.4% to $35 million, although total expenses increased by 8.8% non-revenue-related costs rose by $2.6 million, and losses narrowed to $10.9 million.

Television revenues decreased by 8.7% to $97.5 million, national revenues declined 11.5% and local revenues declined 9.0% EBITDA decreased by $5.4 million, to $13.3 million.

However, the view ahead is positive, with LiSTNR reaching EBITDA profitability in Q4, and “expected to be cash flow positive in FY25.

SCA is also looking to shed some assets, telling the market: “We are currently in active negotiations with several parties for the sale of our regional television licences. We will update the market further with material developments.”

SCA CEO John Kelly said the company’s sales teams has “a strong platform for continued growth into FY25″.

“In the fast-growing digital audio sector, LiSTNR has reached over two million signed-in and addressable users, with around one million of these interacting with LiSTNR monthly,” Kelly said.

“This is testament not only to the range of engaging content on LiSTNR but also to the excellent and personalised user experience delivered by LiSTNR.

“The LiSTNR AdTech Hub is driving premium commercial returns for our advertisers and driving growing interest. The LiSTNR AdTech Hub enhances our advertisers’ ability to connect with relevant audiences on LiSTNR and other digital audio distribution platforms.

“With the LiSTNR AdTech Hub and centralisation of SCA’s audio operations largely complete, our capex program is continuing to slow. Capex will be around $10 million in FY25.

“The SCA team has worked diligently to constrain costs against the backdrop of inflationary pressures. In FY24 we kept non-revenue-related costs to $308.4 million (excluding non-recurring items), below our guidance of $310 million, and we are activating further meaningful and permanent cost reductions for FY25. Coupled with reduced capex, this ongoing cost control will deliver improved cash conversion in FY25 and beyond.

“We have re-commenced a strategic review of our non-core regional television assets and are in active negotiations with several parties with an interest in acquiring those assets. The sale of our regional television assets will enable us to focus on optimising our leading radio and digital audio assets, led by LiSTNR, HIT and Triple M.”

Linkedin

Linkedin

Have your say